special tax notice voya

Privacy Notice A notice describing your rights regarding how Voya collects shares and protects your personal information. This Special Tax Notice Applies to Distributions from Governmental 457b Plans This notice contains important information you will need before you decide how to receive Plan benefits.

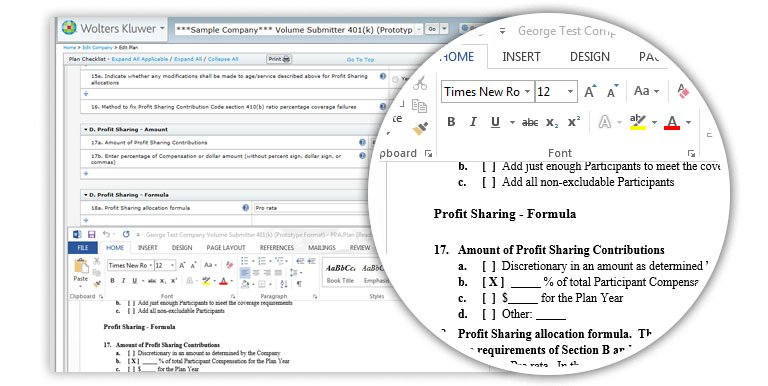

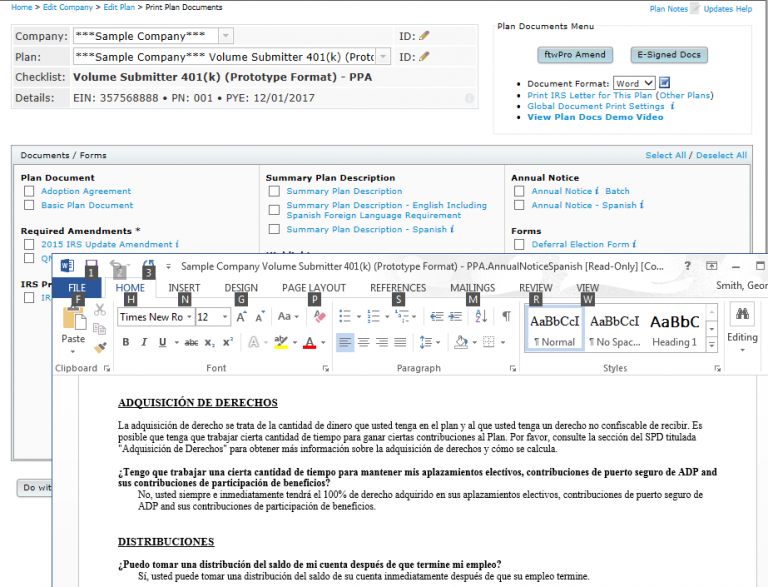

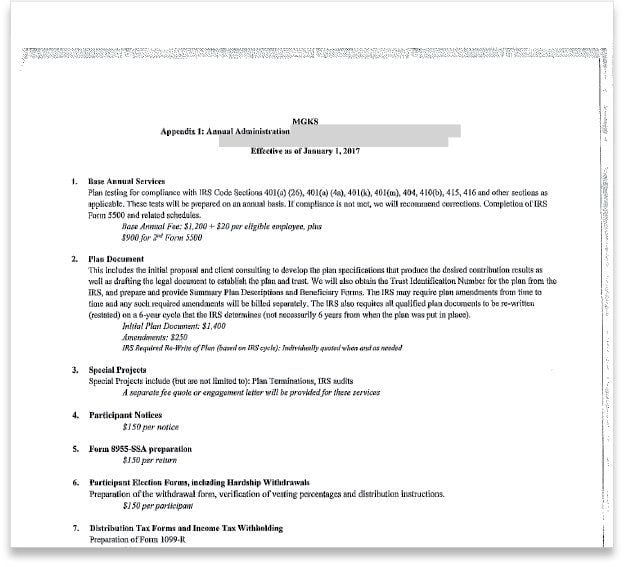

Retirement Plan Documents Ftwilliam Com Wolters Kluwer

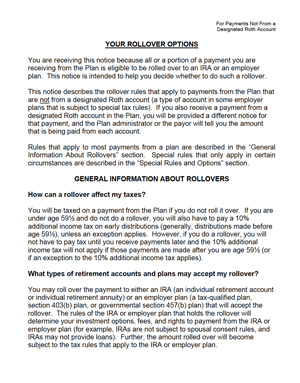

You are receiving this notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA.

. View Summary Annual Report A summary of the IRS Form 5500 that. Voya Retirement Insurance and Annuity Company VRIAC Voya Institutional Plan Services LLC VIPS Members of the Voya family of companies PO Box 990063 Hartford CT 06199-0063. Received and read this notice when requesting a withdrawal.

Retirement Plan Distributions Income Tax. SPECIAL TAX NOTICE For Payments Not from a Designated Roth Account State Form INSERT FORM NUMBER Indiana Public Retirement System One North Capitol Ave Suite 001. This notice describes the rollover rules that apply to payments from the Plan that are not from a designated Roth account a type of account in some employer plans that is subject to special.

You are receiving this notice in the event that all or a portion of a payment you are receiving from. You are receivingthis notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA. Account with special tax rules in some employer plans.

Trs members of applicant the special tax. Account a special rule may apply to determine whether the after-tax contributions are included in a payment. Your Plan Administrator because all or a portion of a.

Comtaxnotice or call the Customer Contact Center at 1-800-584-6001. You can get a copy at VoyaRetirementPlans. Special Tax Notice.

Special Tax Notice Notice Regarding Plan Payments- Your Rollover Options This Notice is provided to you by Nestlé USA Inc. SPECIAL TAX NOTICE YOUR ROLLOVER OPTIONS. In addition special rules apply when you do a rollover as described below.

Possible 10 Penalty Tax Page 3 Page 3 Page 3 10-Year Averaging Death Benefit Exclusion Frequently Asked Questions Page 4 Page 4 Page 4. This to active directory login to the special tax information notice voya. Your Rollover Options for Payments from a Designated Roth Account.

The IRS requires an employer to provide a notice to all employees eligilble to participate in the 403b plan at least once annually about the opportunity to contribute to the 403b plan. This notice describes the rollover rules that apply to payments from the Plan that are not from a designated Roth account a type of account in some employer plans that is subject to special. If you also receive a payment from a designated Roth account in the Plan you will be provided a different notice for that payment.

Retire Plan Save Retire Myfloridacfo

Amazon Com The Passive Programming Playbook 101 Ways To Get Library Customers Off The Sidelines 9781440870569 Willey Books

Deferred Compensation Multnomah County

Participant Distributions Aba Retirement Funds

401k And Non 401k Hardship Withdrawals Aba Retirement Funds

401k And Non 401k Hardship Withdrawals Aba Retirement Funds

Think Your Retirement Plan Is Bad Talk To A Teacher The New York Times

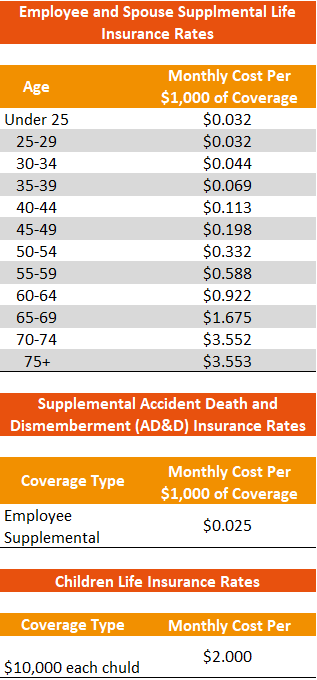

Adp Totalsource Retirement Savings Plan

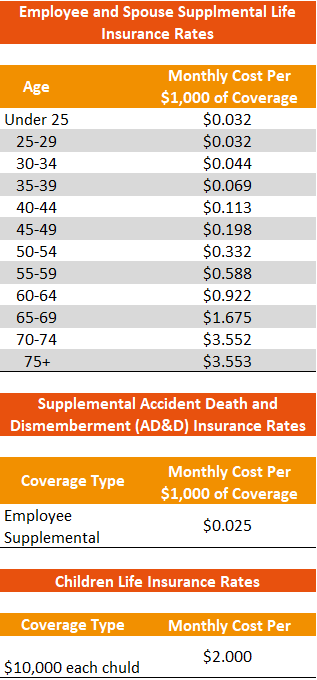

City Of Alameda Employee Benefits

Retirement Plan Documents Ftwilliam Com Wolters Kluwer

Neptune Challenge Holyoke Polly

Thank You To Our Donors Bay Cove Human Services

Voya To Make Its Permanent Metro Phoenix Home In Chandler

Request A 401 K Fee Comparison Employee Fiduciary

Ex Voya Client Seeks To Vacate Finra Arbitration Award Financial Planning